Debit to Income Ratio

Your debt-to-income (DTI) ratio is the percentage of your monthly gross income that goes towards pay

Understanding your DTI

When processing your loan application, lenders will calculate your monthly debt expense, including future mortgage amount, and use this to determine your DTI. Generally, the lower your DTI ratio, the more likely you are to qualify for a mortgage.

Calculating your DTI

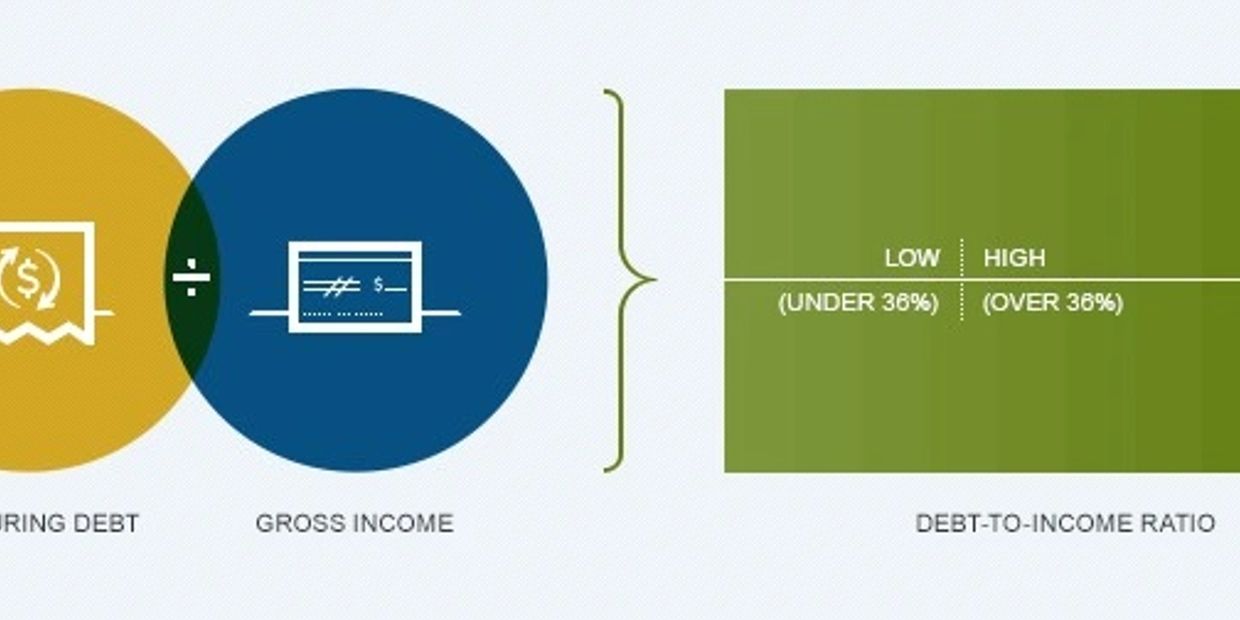

Your DTI ratio is calculated by dividing your debt by your income.

For example, if your monthly income is $4,000 and your monthly debt expense plus future mortgage amount is $1,320, your DTI ratio is 33%. Most mortgage options have specific DTI ratios.

How to reduce your DTI ratio

If you'd like to lower your DTI ratio, try:

- Reducing your outstanding debt

- Limiting your credit card usage

Copyright 2013. Rick Plutchak. All rights reserved.

Equal Housing Lender. This financing is designed to assist you in selecting the loan program that most closely suits your budget. Financing is shown for comparison only. This is not an offer of credit or commitment to lend. Loans are subject to buyer/property qualification. Rates/fees are subject to change without notice. Cash reserves may be required for some conventional loans. DRE License #01259412 NMLS #333242.

Powered by GoDaddy

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.